Medicare Premiums for 2012

Part A: (Hospital Insurance) Premium

Most people do not pay a monthly Part A premium (Medicare beneficiary or a spouse has 40+ quarters of Medicare-covered employment).

- The Part A premium is $248.00 per month for Medicare beneficiares with 30-39 quarters of Medicare-covered employment.

- The Part A premium is $451.00 per month for people who are not otherwise eligible for premium-free Hospital Insurance and have less than 30 quarters of Medicare-covered employment.

Part B: (Medical Insurance) Premium

The standard Medicare Part B monthly premium in 2012 will be $99.90, which represents a $15.50 decrease from the 2011 premium level of $115.40 applicable to newly eligible Medicare beneficiaries. For existing Medicare beneficiaries who were exempted from Medicare Part B premium increases in 2010 and 2011, the new 2012 premium level represents a $3.50 increase over the $96.40 monthly amount currently paid.

In 2012, Social Security monthly payments to enrollees will increase by 3.6%. The dollar increase in benefits checks is expected to be sufficient on average to coverage the $3.50 increase in the Medicare Part B premium that most beneficiaries will experience. For Medicare beneficiaries who were new to Medicare in 2010 or 2011 and were paying a standard monthly premium in excess of $96.40, their benefit checks will increase in 2012.

In most years, Social Security benefits are increased with a cost-of-living adjustment (COLA) and the Medicare Part B premium is raised at the same time. In the two year period 2010-2011, however, with no COLA increases applying to Social Security benefits, the increase in the Part B premium applicable to new Medicare beneficiaries would have resulted in most people seeing a decrease in their net benefits (i.e., their monthly Social Security benefit less deduction of the Medicare Part B premium). Since the Social Security Act protects against such a net decrease (except for those subjected to an income related increase in the Part B premium), the 2009 Part B premium level of $96.40 has continued to apply for most people who were on Medicare prior to January 1, 2010. Now, their premium will be increasing to $99.90 on January 1, 2012.

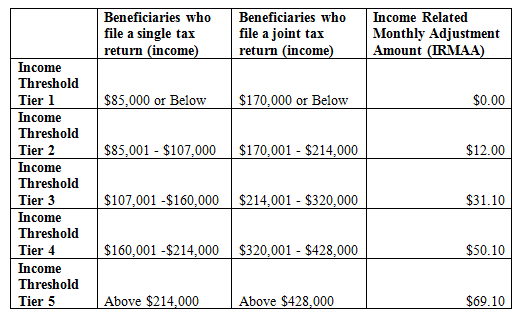

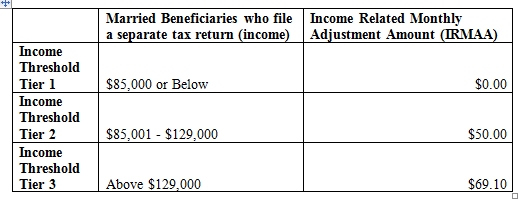

As required in the Medicare Prescription Drug, Improvement, and Modernization Act of 2003, beginning in 2007 the Part B premium paid by a Medicare beneficiary each month is based on his or her annual income. If a beneficiary's "modified adjusted gross income" is greater than the legislated threshold amounts, then the beneficiary is responsible for a larger portion of the estimated total cost of Part B benefit coverage. The income-related amounts were phased in over three years, beginning in 2007; and currently about 4% of Part B enrollees are subject to these higher Medicare Part B premium levels.

For complete details on Medicare Part B premiums for people with higher income levels, please refer to Medicare's FAQ titled:

"2012 Part B Premium Amounts for Persons with Higher Income Levels"

Medicare Deductible and Coinsurance Amounts for 2012

Part A (pays for inpatient hospital, skilled nursing facility, and some home health care). For each benefit period Medicare pays all covered costs except the Medicare Part A deductible (2012 = $1,156) during the first 60 days and coinsurance amounts for hospital stays that last beyond 60 days and no more than 150 days.

For each benefit period the Medicare beneficiary pays:

- A total of $1,156 for a hospital stay of 1-60 days

- $289 for days 61-90 of a hospital stay

- $578 per day for days 91-150 of a hospital stay (Lifetime Reserve Days)

- All costs for each day beyond 150 days

- For Skilled Nursing Facility, $144.50 per day for days 21-100

Part B (covers Medicare eligible physician services, outpatient hospital services, certain home health services, durable medical equipment). In 2012 the Medicare beneficiary pays:

- $140.00 deductible per year, then 20% of the Medicare-approved amount for services

The $140 Medicare Part B deductible reflects a $22 decrease from the $162 level applicable in 2011. While the Medicare Part B deductible level usually is increased each calendar year, in 2012 the deductible amount actually is decreasing in anticipation of a reduced level of Medicare payments to physicians.

For additional details, please refer to Medicare's Fact Sheet titled:

"Medicare Premiums and Deductibles for 2012"

Until next time,

Andrew Herman