Medicare Part D Downfalls

The turn of the year always brings changes to Medicare benefits… but this year wealthier people get a special change to their Part D premium to reward them for their high income.

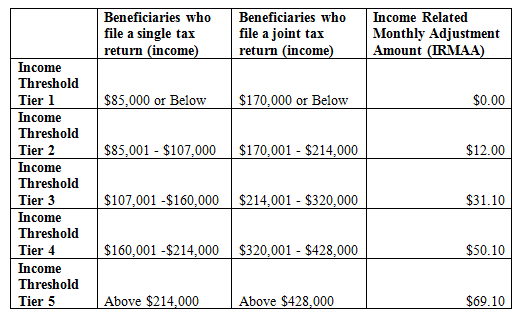

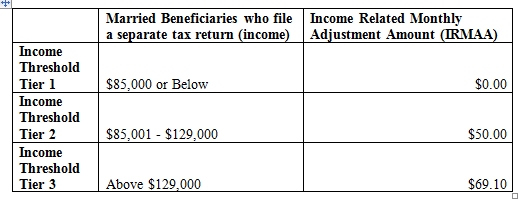

So what’s the change? Starting January 1, 2011, Medicare beneficiaries face a new income related monthly adjustment amount (IRMAA) to their Medicare Part D premiums. Depending on income as filed on the 2009 tax return, an additional sum may be due each month:

How will you know for certain what you will be required to pay? The Social Security Administration will send you a letter in the mail notifying you of the extra amount that must be paid for the IRMAA.

The surcharge on your Medicare Part D premium is NOT to be paid to the provider of your Part D drug plan. Regardless of the method used to submit normal Part D premiums to your insurance provider, the extra monthly cost required by the IRMAA will be collected by the Social Security Administration. Please remember, if you do not have a Medicare Part D drug plan, you will not have to pay any extra money in Medicare premiums.

Until next time,

Andrew Herman

AH Insurance Services, Inc.

No comments:

Post a Comment